Passive Income with BingX (Bingbon)

The copy trading feature on BingX (Bingbon) has become extremely popular, with great traders rising to the top and gaining a huge following worldwide.

With growing popularity, many users have contacted the Bingbon team with great questions about the different features of copy trading. In this article, we will attempt to answer some of the popular questions we receive from users.

If you have a question about copy trading, please contact support on the website, Twitter or Telegram!

1. Selecting a Copy Trader

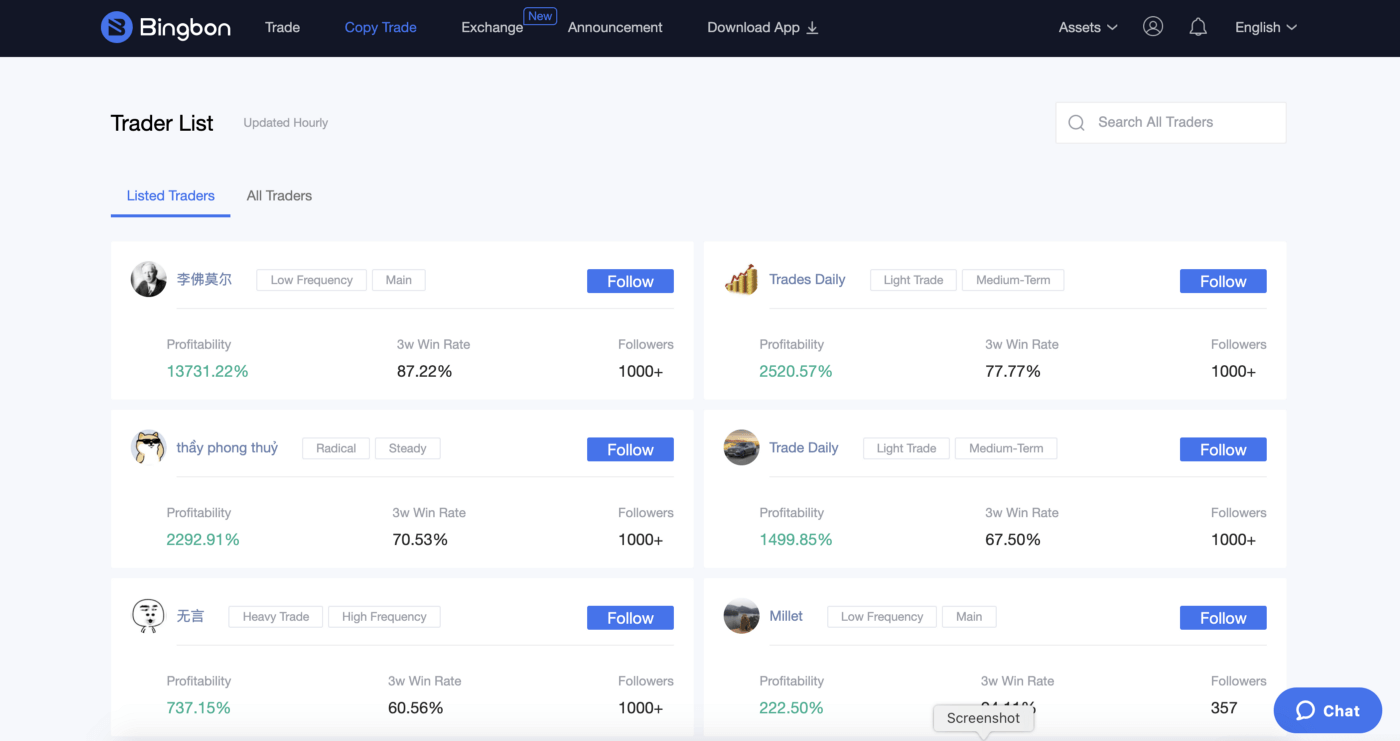

Go to “Copy Trade” in the top menu on bingbon.com or go to “Community” on the Bingbon App. You will be taken to the Trader List, in which you can see a list of verified traders and their profile preview.

For more detailed information about the trader’s performance, you can click on their usernames and you will be taken to the Trader Profile. You can choose the trader you want to follow based on their profitability, max. DD, and their position history (in the Trader Profile), etc.

Once you make your choice, click “Copy”.

2. Copy Trading Settings

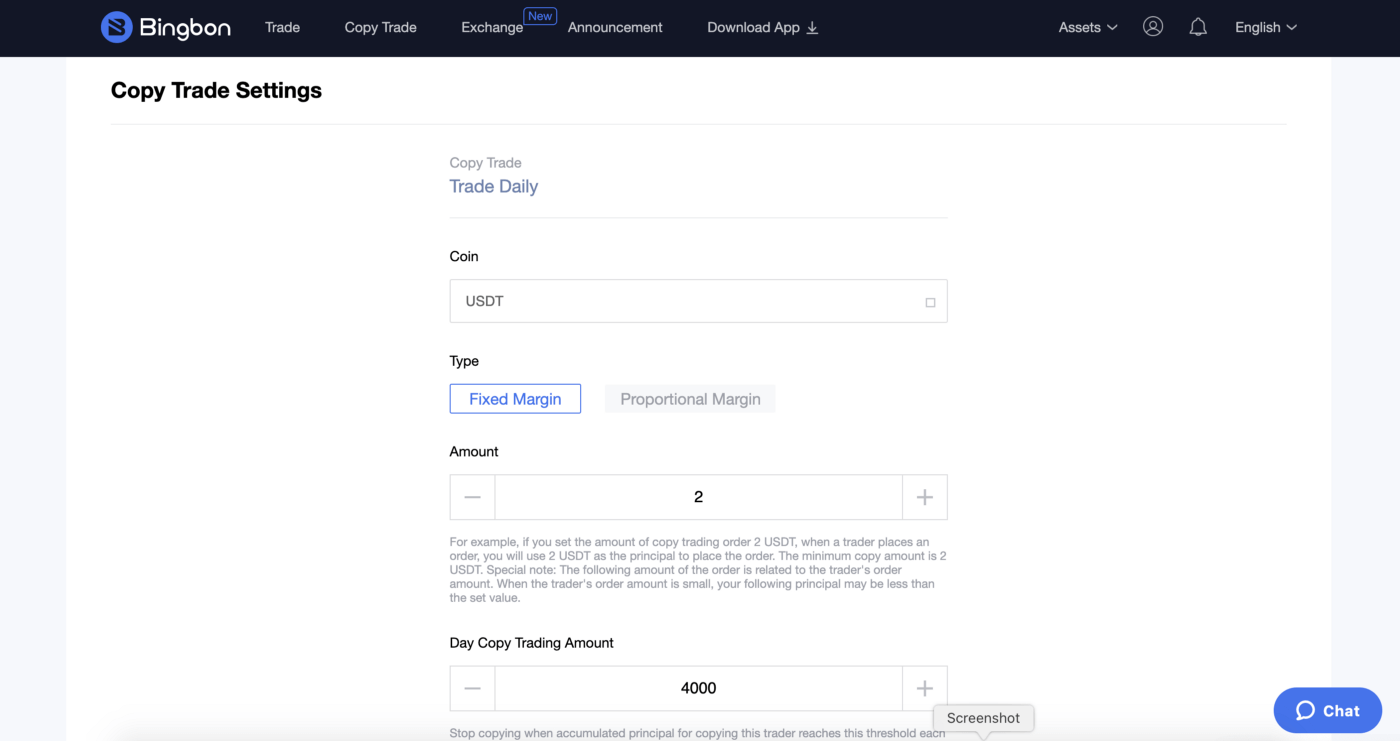

After you clicked “Copy”, you will be taken to the Copy Trading Settings. Here, before you actually start copying this trader, you can set your:

- Coin. Here you can choose between USDT and VST to decide which kind of margin you are trading with.

- Type. Here you can choose between Fixed Margin and Proportional Margin. (For more details, please check the FAQ down below.)

- Amount/Unit Standard.

- For Fixed Margin, you can set the Amount. Amount refers to the Margin for a single copy trade, i.e., no matter what the margin the trader sets is, your margin of the trade does not change.

- For Proportional Margin, you can set the Unit Standard. It allows you to set the margin for a copy trade on a per-unit basis.

(For more details about Fixed and Proportional Margin, please check the FAQ down below)

- Max. Daily Copy Trade Margin. Here you can set a maximum limit to your copy trading margin. Once your accumulated margin for copying this trader reaches the amount you set, you will no longer copy this trader until the next day.

Click “Advanced Settings”. Here you can set:

- Max. Open Position Amount. It is the maximum amount of margin of open positions of copy trades. Once the copy trade margin reaches the set amount, no more copy trades will be opened until some open positions are closed.

- Stop Loss Ratio. For example, after setting the Stop Loss Ratio at 70%, when you lose 70% of the margin, the trade will be automatically closed.

Once you finish with the settings, click “Copy” to start copying the trader.

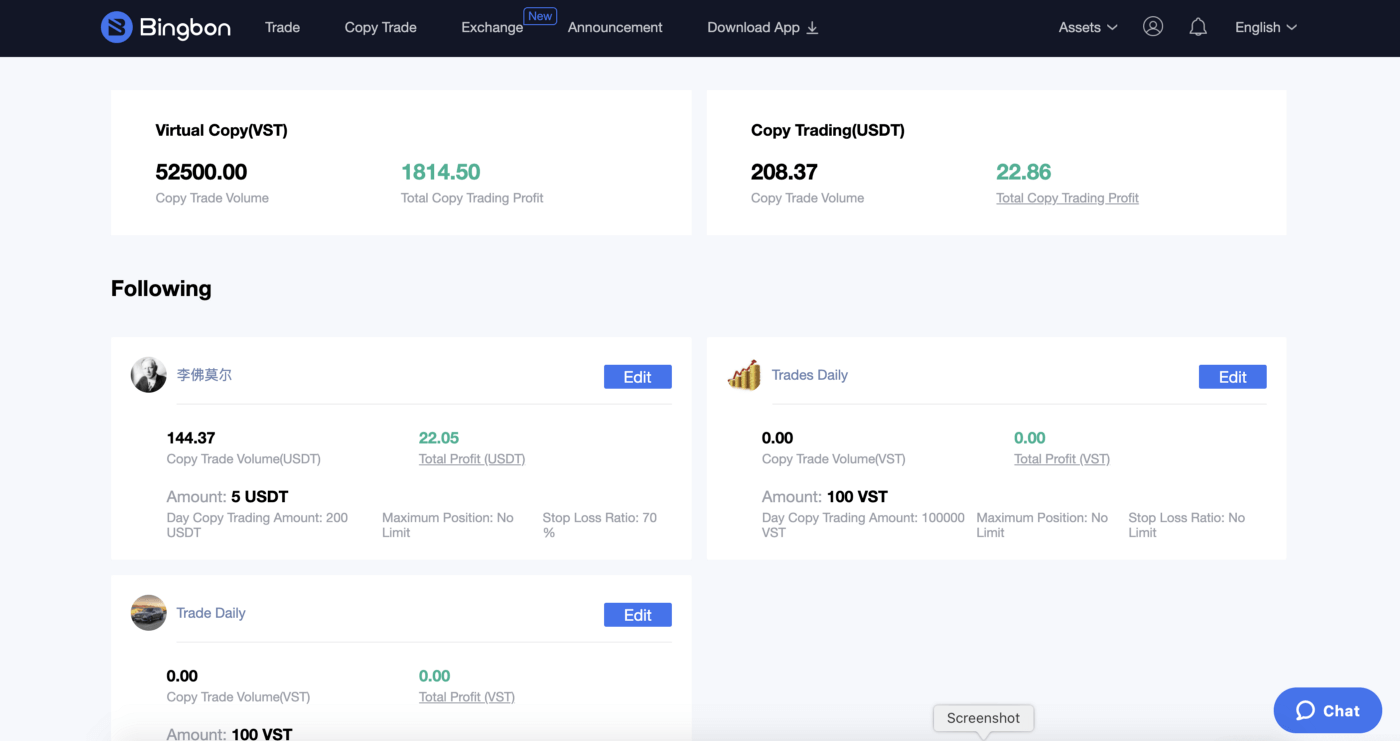

3. Edit Copy Trading Settings & Stop Copying

You can edit the copy trading settings of a trader you followed at any time. To do so, go to Account (For the web version, it is located on the top right corner of the web page) and click “Copy Trading”. Then you will be able to see all traders that you follow.

Click “Edit” to adjust the copy trading settings.

To stop copying this trader, click “Stop Copying” on the top right corner of the copy trading settings page. After you stop copying the trader, you will no longer follow his/her new orders. Orders that have already opened will remain active and under the control of the trader, or you can close these trades manually.

Frequently Asked Questions (FAQs)

- I set my margin to 100 USDT, but when the trader opened a trade, I only copied with 20 USDT. Why is this?

To control the risk to traders, Bingbon has implemented a limit on how much margin the followers of a copy trader will open a trade with based on the position size of the copy trader.

For example, a copy trader opens a position with 100 USDT margin. The Bingbon copy trade system limits the position size of all followers to 40x the copy traders position margin, so in this case, 4,000 USDT.

If 50 users are copying this trader with 100 USDT, this would be 5,000 USDT of margin for the trade, which would be over the 4,000 USDT limit. In this case, the positions of the followers would be reduced by 20% to fit the limit, so the following margin would be 80 USDT, lower than their set 100 USDT.

With popular copy traders, you can see how quickly this allocation can be taken. - What is the difference between Fixed Margin and Proportional Margin?

Fixed Margin allows you to easily control the amount of margin per trade. Every time the trader opens a position, you will follow with the margin amount you set.

For example, the trader opens a trade with 100 USDT. You set the Amount at 2 USDT, then you open the copy trade with 2 USDT.

Proportional Margin allows followers to set the margin on a per-unit basis for Martingale Strategy or other strategic copy trading.

For example, the trader opens a trade of 1 unit, and opens another trade of 2 units. When you use proportional margin and set 10 USDT/unit for copy trading, the system will open your first copy trade of 10 USDT, and the second copy trade of 20 USDT.

The number of units that the trader opens a trade with depends on their set unit. For example, if the trader sets the unit at 100 USDT/unit, when the trader opens a trade with 100 USDT, they will open the trade with 1 unit. - What are the fees for copying a trader?

There are 2 fees associated with copy trading, Trading Fees and Profit Share.

Trading Fees: 0.045% for crypto, 0.03% for non-crypto.

Profit Share: 8% of the daily net profit.