What Is a Layer 2 Protocol in Crypto?

Remember when having 16 gigabytes of storage on your smartphone was an incredible amount? Just as the technology of your smartphone has adapted for current demands, so have many of the world’s leading cryptocurrencies.

Why Layer 2 Is Necessary

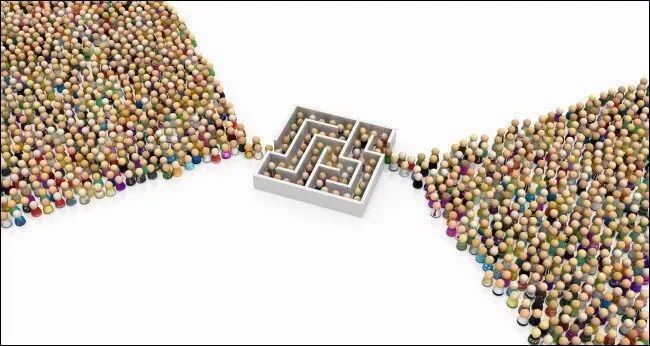

A few years ago, blockchains were more than capable of handling the traffic on their respective networks. The amount of users has grown exponentially since then. As more people use cryptocurrencies today, these networks are becoming bogged down with traffic. The traffic on some of these blockchains leads to high fees and slow processing times.

To mitigate congestion, developers created secondary blockchains that work in conjunction with the main blockchain. This technology is known as a Layer 2 protocol. They have virtually no capacity limits, increase transaction speeds, lower fees, and make Layer 1 blockchains more efficient.

The processing of transactions quickly and cheaply is known as scaling. Bitcoin and Ethereum have become some of the most notorious Layer 1 blockchains that do not scale well. Bitcoin can only process about 5 to 7 transactions per second, and Ethereum processes about double that amount.

Layer 1 vs. Layer 2: A Real World Comparison

Let’s imagine transactions on a blockchain as pieces of mail. Carriers that deliver mail only by automobile would be similar to a Layer 1 blockchain that doesn’t scale efficiently (Bitcoin or Ethereum).

Some carriers utilize airplanes to transport mail. They are able to transport large amounts of mail and packages across long distances effectively. These airplanes carrying mail are the equivalent of Layer 2 protocols. The mail still arrives in the same place, albeit much faster and in a more cost-effective manner.

In the same fashion, Layer 2 protocols can carry more transactions and then “deliver” them to the Layer 1 blockchain at a later date. The end result is still the same, but the manner of transport is just a little different.

Rollups, Sidechains, and Channels

There are varying methods that Layer 2 solutions use to interact with the Layer 1 blockchain they support. Rollups, sidechains, and channels are all examples of Layer 2 methodologies. Each has advantages and disadvantages. The important thing to remember is that they all accomplish the same goal; increase transaction speeds and lower fees for Layer 1’s.

Rollups bundle multiple transactions into one and deposit them back to the Layer 1 blockchain at a later date. They truly are a second layer on top of the Layer 1 blockchain. One of the most well-known rollups for Ethereum is Loopring.

Unlike rollups, sidechains are completely separate blockchains that connect and relay transactions to the Layer 1 network concurrently rather than waiting. Think of a sidechain like a bridge connecting the two blockchains. For example, Polygon is a high-profile sidechain that helps scale Ethereum.

Channels track multiple payments between two users, kind of like rollups. Contrary to rollups, however, channels only record two transactions on the Layer 1 blockchain. If the same one dollar was sent back and forth between two people 20 times, rollups would have 20 transactions. With channels, only the final amount each user possesses is added to the Layer 1. The Lightning Network is considered a Layer 2 solution and is the most popular scaling option for Bitcoin.

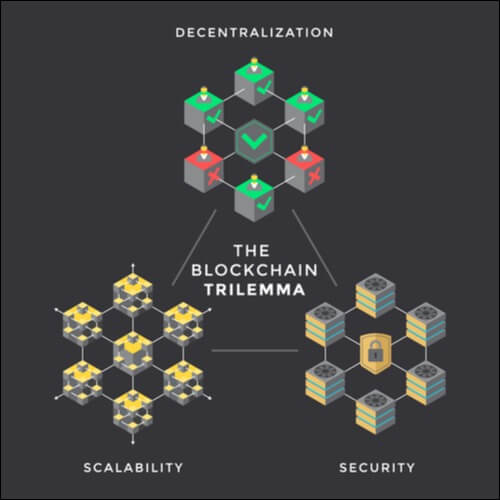

The Blockchain Trilemma

So why don’t all Layer 1 blockchains need a Layer 2 solution? The answer lies in understanding certain limitations of building a blockchain.

Scaling is one of three defining features that make up a blockchain. The other two are decentralization and security. These three features have become known as the “Blockchain Trilemma”, a term coined by Ethereum founder Vitalik Buterin. It is referred to as a trilemma because there is no blockchain that doesn’t compromise at least one of these three facets. As of now, there is no cryptocurrency that is able to achieve maximum scalability, security, and decentralization.

In other words, cryptocurrencies pick two of three of these features to focus on, to the detriment of the third.

An overview of the top 10 cryptocurrencies by market cap today reveals that some are scalable and secure, some are secure and decentralized, and some are decentralized and scalable. The important thing to note is that none are able to achieve a maximum of all three. There is always a tradeoff of some sort.

Cryptocurrencies like Cardano, Avalanche, or Solana are Layer 1’s that have made a name for themselves by capitalizing on Bitcoin and Ethereum’s scaling issue. The aforementioned cryptocurrencies can process thousands of transactions per second but they sacrifice decentralization or security. In contrast, Bitcoin and Ethereum are two of the most secure and decentralized cryptocurrencies.

Layer 2’s for the Long Haul

As of March 2022, Bitcoin and Ethereum made up more than half of the entire cryptocurrency market cap. These blockchains support a vast number of users and DeFi ecosystems. Other Layer 1’s (Cardano, Avalanche, Solana, etc.) have begun to grab more of the market share but they lack some of the intrinsic decentralization and security that make Bitcoin and Ethereum so unique.

For users that value these characteristics, Layer 2’s promote utility for these blockchains that would otherwise be costly and slow.